With low interest rates, a turbulent stock market, and increased concerns about climate change, many investors are looking to create stable returns while helping to fight climate change. If this sounds like you, look no further as RE Royalties Green Bonds are now available.

Let’s take a closer look at some of the benefits of investing in RE Royalties Green Bonds.

Income

Are you looking for predictable and stable returns in time of economic uncertainty? The COVID-19 pandemic has created an unpredictable stock market and the world is now in a low interest rate environment, neither of which are good for your returns.

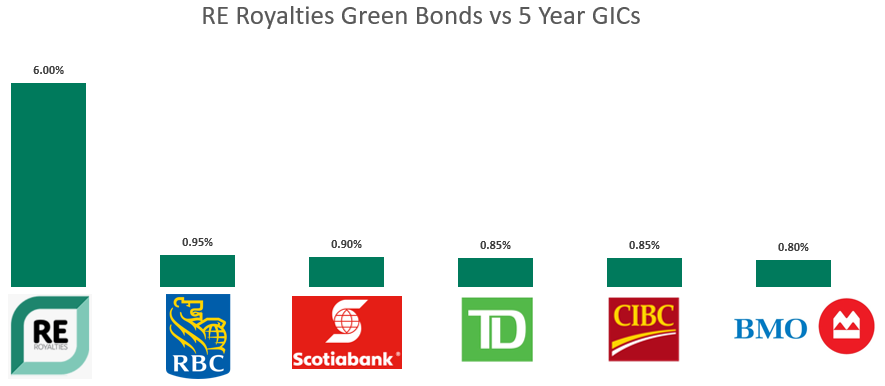

That’s why it’s nice to see an investment that offers such a modest, steady return. With RE Royalties Green Bonds you can expect to earn 6% per annum. That’s better than high-interest savings accounts and guaranteed investment certificates (GICs) and a good return overall. With the big Canadian banks offering 5 year GICs with much lower rates, a return of 6% on your investment is quite the benefit.

Security

Not only do RE Royalties Green Bonds offer a compelling return, they are also secure. Unlike similar Green Bonds, RE Royalties Green Bonds are senior-secured by a diversified portfolio of renewable energy investments. You can read RE Royalties Offering Memorandum for more details on how your investment is safe, but needless to say you’re getting a higher return for less risk. It doesn’t get any better than that! The portfolio backing your investment includes 69 solar, 14 wind, and 3 hydro projects with a combined capacity of 472 MW.

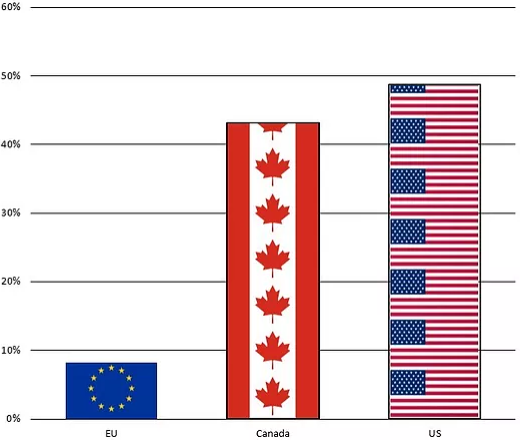

Not only do you get diversification in the underlying assets, but they also offer geographic diversification with a global presence. RE Royalties has renewable energy projects in the USA, Canada, as well as the EU so you can be sure that your investment is safe and secure.

Impact

With RE Royalties Green Bonds, you are generating financial return for yourself, but you are also creating positive social and environmental changes. You can earn a stable return while also helping to fight climate change.

When you invest in Royalties Green Bonds, you’re investing knowing that you’re helping reduce your carbon footprint and you’re directly funding the growing green economy. The money you invest in RE Royalties Green Bonds will be used to finance clean energy projects. The mandate of RE Royalties is to only invest in sustainable and renewal energy projects that will lower greenhouse gases and reduce the impact of climate change.

One of their recent projects was helping a renewable energy company in Halifax refinance their existing loan. RE Royalties has been very active in their investments and you can read more about their past activity and portfolio here.

Some of these renewal energy companies are too small to borrow from the banks and don’t want to dilute themselves by issuing more equity. You can sleep well at night knowing you’re making a real difference and helping these smaller companies out.

Registered Accounts

With RE Royalties Green Bonds, you can earn a 6% return annually for a 5-year term and that’s not all. Interest is paid quarterly, making them a great investment for anyone who’s looking for income with their investments.

RE Royalties Green Bonds are accessible for the everyday investor. The minimum investment amount is $5,000. This is quite reasonable and makes it easy for everyone from beginning to more experienced investors to invest.

Green Bonds are flexible in the sense that they can be held in a variety of registered accounts. You can hold them in RRSPs, TFSAs, RRIFs and RESPs.

The Bottom Line

You’ll be hard-pressed to find a similar investment offering that offers so much for so little. With RE Royalties you can earn strong, consistent returns in an industry that’s mandate is to provide a better future for everyone.

Sean Cooper is the bestselling author of the book, Burn Your Mortgage: The Simple, Powerful Path to Financial Freedom for Canadians, available now on Amazon and at Chapters, Indigo and major bookstores, and as an Audiobook on Amazon, Audible and iTunes.