Are you looking for a loan or financing? More Canadians than ever before are shopping online for financial products these days. While this presents a great opportunity to save money, it’s equally important to ensure you’re dealing with reputable companies. That’s where a website like Smarter Loans comes in handy.

Smarter Loans prides itself as being Canada’s Loan Directory. It aims to be a destination to help Canadians make smarter financial decisions when it comes to borrowing and managing money. When you just come to the site it is clear that Smarter Loans is a great place to discover financial products available on the market and the companies behind them.

What is Smarter Loans?

Smarter Loans offers something for everyone. Visitors to Smarter Loans can learn about a wide variety of topics, such as personal and business loans and financing, credit cards, savings and chequing accounts, credit score monitoring and improvement, debt solutions, investing, saving and managing money.

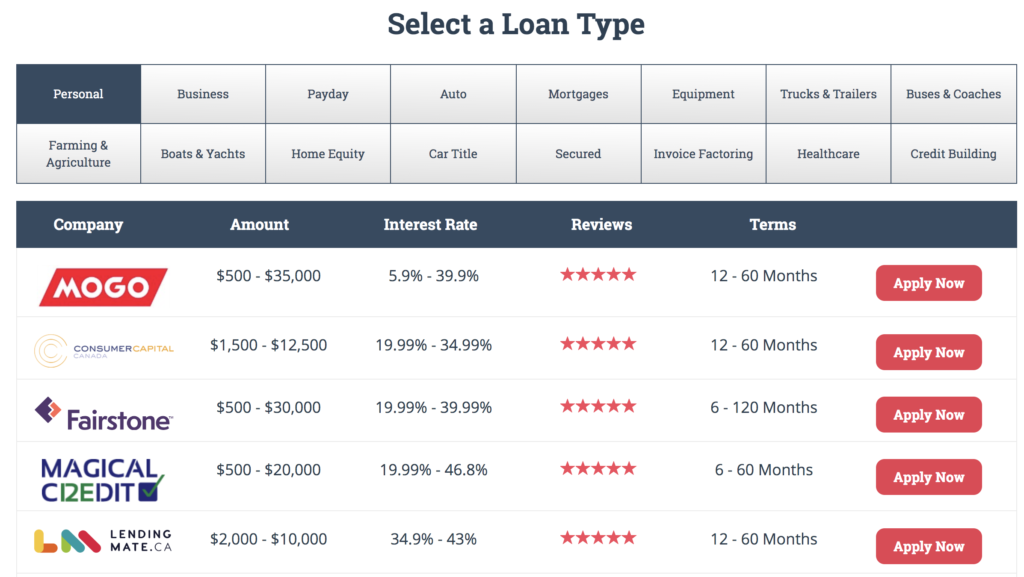

Finding a loan on Smarter Loans is a simple and easy process. When you visit its main page, you’re greeted by a list of loan companies that operate in Canada. You can narrow down the list of lenders by choosing the appropriate loan type. For example, some people might be looking for a personal loan, while for others might be looking for a mortgage. You can choose the loan type you’re interested in and you’ll instantly see a list of loan companies along with their various product offerings.

When you see something you like, the application process is easy, simply click on the “Apply Now” button to be brought to the application form on the lender’s website.

Smarter Loans offers information on a wide range of financing companies including personal, business loans, payday, auto, mortgages, equipment, trucks & trailers, home equity, car title, secured and more.

Pre-Applying for a Loan

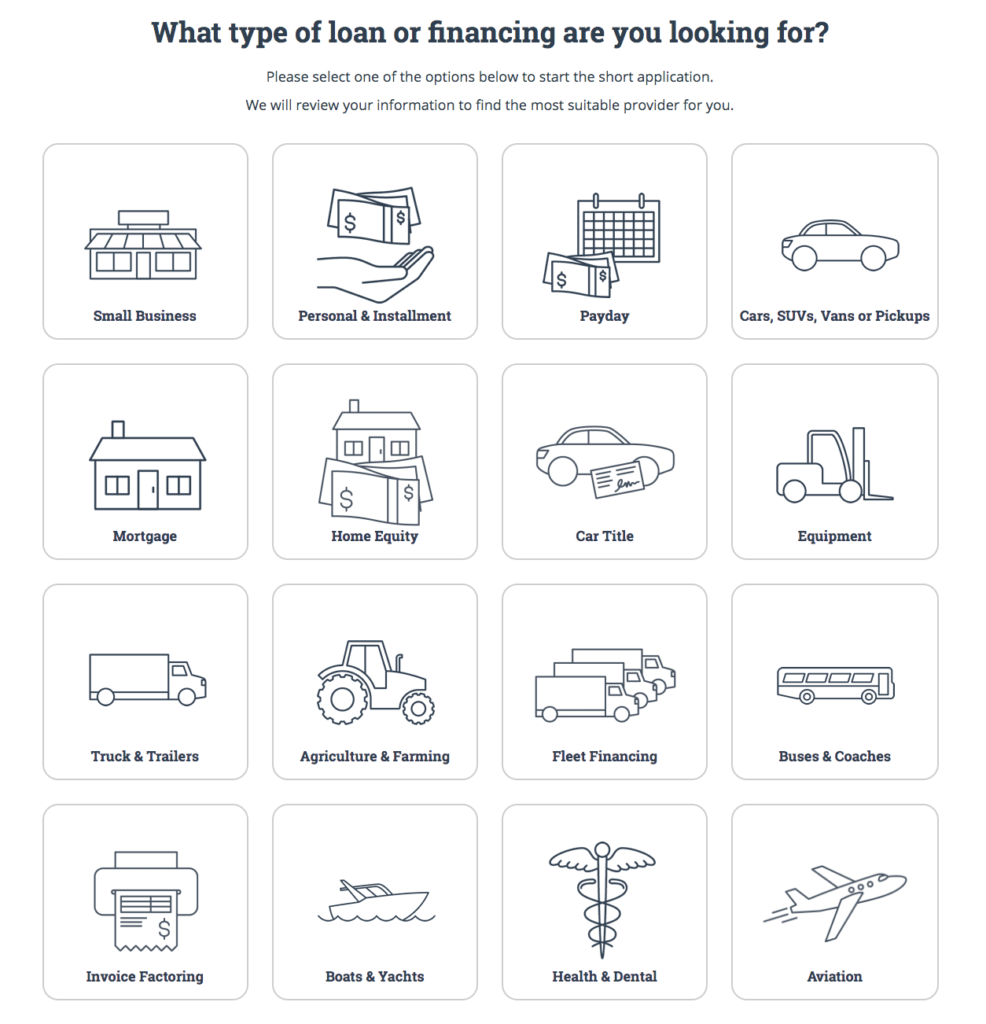

If you don’t want to spend time reading about each company or their products, you can let Smarter Loans do the work for you. When you click the “Pre Apply” button on the Smarter Loans homepage, you can tell Smarter Loans what you’re looking for and they will find a lender or lenders in their network that have the highest chances of approving you (based on the info you provided).

Choose from the type of loan or financing you’re looking for to start the short application. In the application form you’ll be asked to provide basic information like your name, email address, province, how much you’d like to borrow and the loan purpose. Smarter Loan will then review the information you provided to find the most suitable lender for you.

There are several benefits of pre-applying for a loan with Smarter Loans: wide range of loan options available, only deal with trustworthy loan companies in Canada, get matched up with the right lender to help get approved quickly and easily, avoid applying with multiple companies individually.

A Name You Can Trust

Smarter Loans is big on educating its users. To that extent it has an extensive library of articles on a wide variety of personal finance and lending topics. You can find all of that in the Learning Centre. They work with many bright minds & writers in the financial industry to produce educational articles. Some of the writers & experts that they work with can be found in the Our Experts section. Collaborations with experts focus on topics outside of just financing, and include things like saving, getting out of debt and taking your business to the next level.

One of the reasons that Smarter Loans is a name you can trust is because they have been featured in some of Canada’s biggest national publications, including the Toronto Star and National Post.

Smarter Loans is a thought leader in the Canadian financing space. Last year it published a study on the “State of Alternative Lending in Canada.” The study received coverage in major publications including the National Post, deBanked and more.

Loan Directory

On Smarter Loans’ loan directory you’ll find over 40 different financial brands. You’ll find detailed profiles on each lender, including all the information you need to make a well-informed financial decision. You’ll find each company’s products and details on the products, including interest rates, terms, fees, qualification requirements, comparisons and more.

Smarter Loans only has reputable lenders on its website. In order to get listed on the Smarter Loans loan directory, each company is vetted ahead of time to make sure it’s trustworthy. On top of that, Smarter Loans goes the extra step of having the lenders review their listings to make sure all the information is accurate.

In order to be listed on the Smarter Loans website, all companies must follow responsible lending practices set out by Smarter Loans. Only after a lender passes Smarter Loans’ extensive screening process will it receive the Smarter Loans Quality Badge. This gives Canadians the peace of mind that they’re dealing with a lending brand that they can trust.

YouTube Channel

Something really cool about Smarter Loans is its YouTube Channel. On its YouTube channel you’ll find videos from financial experts sharing practical financial advice to help make you a smarter consumer. Something I really like is Smarter Loans’ videos on its lenders. It adds an all-new level of trust with lenders that you won’t find anywhere else.

Why Do Canadians Like Using Smarter Loans?

I’ve spent a fair amount of time browsing the Smarter Loans website and can honestly say that it’s one of the best lending websites out there today. There are several reasons why I like the Smarter Loans website, which I outline below.

- Lot of options. Smarter Loans makes it easy to discover options, compare those options and apply online in seconds. If you’re busy like me, you don’t need to spend a ton of time visiting a bank branch in person. You can apply directly online in your PJs if you want.

- The rigorous approval process to appear on the Smarter Loans website means that you know you’re dealing with a reputable company that’s safe to work with.

- Smarter Loans has expert opinions and reviews and that adds an extra layer of trust.

Smarter Loans isn’t just a loan directory. Canadians have the ability to educate themselves about a wide variety of financial topics explained by industry experts and financial writers.

Key Features of the Smarter Loans Website

The Smarter Loans website has a number of key features that sets it apart from other loan website. Here’s a summary of the key features below.

- Comparison Table: The comparison table lets you narrow down the financing based on loan type, province and even the service area, so can make sure you’re looking at the financing that’s right for you.

- Company Profiles: One of your biggest concerns as a borrower is are you dealing with a trustworthy lender. To help give you the confidence you need, Smarter Loans include a company profile with each lender with all the information you’ll need to move forward with confidence.

- Pre-Applying: This is a feature that’s truly unique to the Smarter Loans website. After describing your financial situation, they will analyze your information and present you with the lending options that make the most sense for you.

- Loan Search Engine: With the Loan Search Engine, you can do custom searches to see lenders that match your criteria.

- Credit Cards Portable: Credit cards are popular among borrowers. As such, to make your search for a credit card easier, Smarter Loans has a portal dedicated to them.

Q&A with Smarter Loans

I had the pleasure of sitting down with the founders of Smarter Loans for an informational Q&A. Here are the topics we discussed.

- What is your mission with Smarter Loans?

At Smarter Loans we want to help Canadians make smarter financial decisions, especially when it comes to borrowing money for any purpose. A lot of people come to our website looking for information on borrowing, loans, financing and financial products. Many also consume other relevant information about financial products, saving money, starting a business, entrepreneurship and just to get their questions answered, so that they can make smarter, better informed decisions when it comes to money.

- Your website has grown significantly since you launched in 2016. Why are more and more people using the service?

The reason people really love using Smarter Loans is because it lets them very easily find any kind of loans or financing and deal with Canada’s most reputable companies. It gives them an easier, safer and more convenient way to obtain a loan of any kind for any purpose. Today we work with over 40 of Canada’s top established financial brands that provide innovative financial products. People come to our website to discover these companies, to learn about them,, compare their options and use these products. As more companies are working with us, more options are available for Canadians. People in turn are continuing to come to our website and that has been driving the growth of it.

- What kind of trends are you noticing in the financial space in Canada?

We’re noticing that more and more people are using the Internet to obtain financing and they apply online in the convenience of their own home. The whole experience is shifting online. With that sometimes comes certain risks. When people go online and rely on the internet to facilitate financial transactions and apply for loans, you want to make sure you’re dealing with reputable companies. You don’t want to be afraid of any kind of fraud or scam. That’s one trend we’re seeing is that people are willing to do things online, but at the same time they’re looking to do it with trusted and authoritative companies.

Innovation is another trend. We’re seeing a lot of innovation from the banks and the alternative lenders to other financial companies. More and more companies are going digital. They’re investing in things like data and trying to understand their customers better to make that user experience better, faster and more convenient. This also includes a number of U.S. companies coming into the industry and bringing some of that innovation with them.

- Why shop around for financial products?

Not only should people shop around, but we feel it’s an absolute must to do it for financial products. People need to really educate themselves when it comes to financial products. The “shopping around” in this case isn’t to pick between colors or a slight discount, its to make a sound financial decision that will help you, and will not hurt you in the future. In fact, it is even more important to consider different options when it comes to loans for example, than if you are looking for a hotel or a new pair of shoes. Financial products are much more complex and have bigger implications on your long-term finances. We are all different as people, consumers, and business owners and the reality is that different financial products are not build in a single size. At Smarter Loans we give Canadians the tools that they need to find the right option for them, and we’re proud of it.

That does it for my interview with Smarter Loans. Visit Smarter Loans today to search for financing at Canada’s most reputable loans companies.

Sean Cooper is the bestselling author of the book, Burn Your Mortgage: The Simple, Powerful Path to Financial Freedom for Canadians, available now on Amazon and at Chapters, Indigo and major bookstores, and as an Audiobook on Amazon, Audible and iTunes.