Being a personal financial expert, I’m the go-to person when it comes to managing my family’s finances. I help my family with day-to-day banking, debt management and investing. But keeping track of my family’s finances isn’t always easy. Sometimes it can seem a bit disjointed. I have to keep track of login information for so many different accounts that it can be confusing at times. My father’s always asking me how his investments are doing (he’s not computer literate), but I don’t always have time to login to every single investment account. There has to be a better way to stay financially organized – and thankfully there is.

Being a personal financial expert, I’m the go-to person when it comes to managing my family’s finances. I help my family with day-to-day banking, debt management and investing. But keeping track of my family’s finances isn’t always easy. Sometimes it can seem a bit disjointed. I have to keep track of login information for so many different accounts that it can be confusing at times. My father’s always asking me how his investments are doing (he’s not computer literate), but I don’t always have time to login to every single investment account. There has to be a better way to stay financially organized – and thankfully there is.

Getting Your Family and You on the Same Financial Page

Onist is a website that promises to get your family and you on the same financial page and have open and “onist” (pun intended) conversations about money. Despite the increasing importance of financial literacy, money remains a taboo topic around many dinner tables. In fact, 40% of spouses are in the dark about their family finances and 33% of couples have fights about money every month. This needs to change.

I signed up for the free Basic Family Plan at Onist to give it a go and here are my thoughts.

Viewing your family’s finances in one place is pretty convenient. I really liked how you get a complete view of your family’s full net worth including assets and liabilities, cash flow and transactions all together. Onist certainly delivers on its promise to simplify your family’s financial life.

Viewing your family’s finances in one place is pretty convenient. I really liked how you get a complete view of your family’s full net worth including assets and liabilities, cash flow and transactions all together. Onist certainly delivers on its promise to simplify your family’s financial life.

The interface is user-friendly and intuitive. When you first sign up, you’re taken on a tour to help you get started. The dashboard gives you a nice overview of Onist and all that it has to offer. You can view your family’s net worth, monitor transactions, securely chat and share files with your family.

To make the most of Onist, you’ll want to connect Onist with your bank accounts. When you do this, your account balances and daily transactions are updated automatically every day.

To connect your bank account, you’ll need to connect using your banking login information. In an era of high-profile data breaches, you may be a little hesitant about sharing this information. Onist says that keeping your personal and financial data safe is its #1 priority. Its website uses several layers of protection from data encryption to de-identification to keep your data safe and secure.

A Handy Tool for Baby Boomers and End-of-Life Planning

With baby boomers in Canada set to inherit an estimated $750 billion over the next decade, the country’s largest ever transfer of wealth, the timing of Onist couldn’t be better. As our parents age, getting their finances in order becomes more important. Onist makes managing your parent’s finances a lot easier. You can create a ‘household’ within your Onist account for your parents. You and your parents can then share their financial accounts and documents with each other you so you can help monitor them as they become less able to manage their finances. I already manage my family’s finances, so this tool really came in handy.

With baby boomers in Canada set to inherit an estimated $750 billion over the next decade, the country’s largest ever transfer of wealth, the timing of Onist couldn’t be better. As our parents age, getting their finances in order becomes more important. Onist makes managing your parent’s finances a lot easier. You can create a ‘household’ within your Onist account for your parents. You and your parents can then share their financial accounts and documents with each other you so you can help monitor them as they become less able to manage their finances. I already manage my family’s finances, so this tool really came in handy.

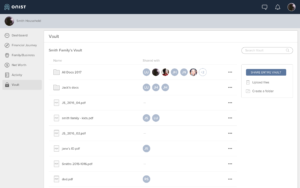

Onist also comes in handy for end-of-life planning. Life has a way of throwing curveballs. Get your family prepared in case something happens to you. With Onist you can store important financial and legal documents in its secure vault. Upload documents such as your will, power of attorney and insurance policies. Keep a record of your family’s medical history and passwords all in one place.

Do you have a financial planner? Onist makes it easier to collaborate. . You don’t have to share everything with your planner. Choose which parts of your finances to share with your financial professionals to help get everyone on the same financial page with just the information they need.

After spending a week using Onist, I can confidently say that it made managing my family’s finances a lot easier. I’d highly recommend it to anyone looking to simplify their financial life. It’s free to sign up and try, so you have a lot to gain and nothing to lose.

Sean Cooper is the bestselling author of the book, Burn Your Mortgage: The Simple, Powerful Path to Financial Freedom for Canadians, available now on Amazon and at Chapters, Indigo and major bookstores, and as an Audiobook on Amazon, Audible and iTunes.