Are you feeling financially squeezed? You’re not alone. While high home prices may be good for baby boomers who bought their homes decades ago, it’s not so great for Canadians in their 40’s struggling to buy their first home. Canadians are constantly told that homeownership is the cornerstone of financial success, yet it’s out of reach for many younger Canadians, struggling just to keep up with rising rents. I know this firsthand – to save for a down payment and pay off my mortgage in three years, it took many sacrifices – it took working three jobs and living super frugally.

Are you feeling financially squeezed? You’re not alone. While high home prices may be good for baby boomers who bought their homes decades ago, it’s not so great for Canadians in their 40’s struggling to buy their first home. Canadians are constantly told that homeownership is the cornerstone of financial success, yet it’s out of reach for many younger Canadians, struggling just to keep up with rising rents. I know this firsthand – to save for a down payment and pay off my mortgage in three years, it took many sacrifices – it took working three jobs and living super frugally.

Generation Squeeze refers to the financial squeeze felt by Canadians in their 20s, 30s and 40s. While Canadians 50+ have the Canadian Association of Retired Persons lobbying to governments on their behalf, younger Canadians are largely on their own – until now. Gen Squeeze is the voice for the voiceless. It gives younger Canadians a voice to lobby to governments to make sure their concerns are heard loud and clear to ensure Canada works for all generations.

The Large Spending Gap in Federal Social Spending

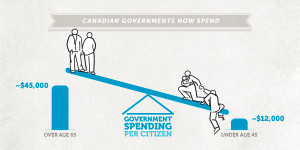

The younger generation is facing many challenges – skyrocketing real estate prices, record-high student debt, unaffordable child care expenses, and a poor job market, to name a few. While the difficulties faced by the younger generation are well-known, what isn’t so well known is the large spending gap in federal social spending.

The stats speak for themselves – the government spends an average of $20,868 per person on Canadians 65 and over (5.8 million people), an average of $7,185 per person on those 45 to 64 (10.1 million people), and an average of $4,349 per person on those below the age of 45 (20.1 million people). When we do the math, that means there’s an average spending gap of $16,519 per person between the oldest Canadians and the youngest Canadians.

It shouldn’t be any surprise the government is spending more on the older generation. As Canadians age and leave the workforce, they need more in the way of financial support. While I’m all for helping older Canadians with rising health care costs and government benefits like Guaranteed Income Supplement and Old Age Security, what I’m not in favour is routinely under-investing in younger Canadians, which appears to be the case.

The younger generation is facing a double whammy of challenges. Not only are younger Canadians shouldering more responsibility to deal with rising home prices, they are being asked to asked to accept a lower public spend on their generation, while spending on older Canadians continues to rise. I don’t think the math adds up.

For the younger generation to be successful, it has to be given a fair chance. Younger Canadians have a better chance of success when they’re not weighed down by a 360 degree squeeze. If we can shine a light and make the generational spending gap a well-known fact, we can help close the spending gap and provide equality to all Canadians.

If you’d like to help give younger Canadians a voice, be sure to sign the Gen Squeeze petition so Prime Minister Justin Trudeau hears the message loud and clear. If you’re interested in learning more about Gen Squeeze, check out the report: Measuring the age gap in Canadian social spending.

Sean Cooper is the bestselling author of the book, Burn Your Mortgage: The Simple, Powerful Path to Financial Freedom for Canadians, available now on Amazon and at Chapters, Indigo and major bookstores, and as an Audiobook on Amazon, Audible and iTunes.

I am interested to know who your readership is. Because I see too many articles complaining by the under 40s about how hard done by they are instead of just soldering on.

It can be done. You talk about your own mortgage experience. We have six kids and one accountant income and we paid our house off in 6 years. And we live a lovely life.

As long as we are in a mindset to whine to the government how little we get from them, then our taxes will always go up. Or if we spend our time looking around at what others are getting, we will always be dissatisfied.