Would you like to burn your mortgage faster? Dividends can help you pay off your mortgage faster than you think. You shouldn’t you have to pay down your mortgage all by yourself, especially when you can use your investments to help you. Here is a safe, low risk, low maintenance way to save $129,608.58 and pay off your mortgage 4.1 years sooner.

Would you like to burn your mortgage faster? Dividends can help you pay off your mortgage faster than you think. You shouldn’t you have to pay down your mortgage all by yourself, especially when you can use your investments to help you. Here is a safe, low risk, low maintenance way to save $129,608.58 and pay off your mortgage 4.1 years sooner.

What is a dividend?

A dividend is money in your pocket. When you own shares in a company, the company will pay you for being a shareholder. As a shareholder you are part owner of the company, the company is simply sharing its profits with you the shareholder. If you own 1000 shares in company XYZ, and the company is paying $1 dividend per share per year, then you will receive $1000 in dividends each year for as long as you own those shares and as long as the company continues to pay that dividend. You can choose to save your dividends, spend them, or use them to help pay off your mortgage faster.

Can I really pay off my mortgage faster?

Yes, and the sooner you start the more money you will earn to help pay down your mortgage. Here’s a real-life example of investments and the amounts of dividends coming in:

| Stock Symbol | Company | Shares Purchased | Purchased In | Initial Investment | Total Dividends Received to date (2018) | Current amount of annual dividends being received | Current Dividend Yield on Cost |

| TRP | TransCanada | 220 | 2010 | $7517.40 | $4382.40 | $785.40 | 8.08% |

| MIC | Genworth | 385 | 2010 | $6537.30 | $5147.45 | $480.00 | 12.01% |

| RCI.B | Rogers | 250 | 2009 | $6550.00 | $4172.50 | $458.15 | 7.33% |

| SJR.B | Shaw | 385 | 2009 | $6926.15 | $3999.96 | $607.20 | 6.61% |

| TOTAL | $27530.85 | $17702.31 | $2330.75 | 8.51% (average) |

In this example I’ve used the following values:

Mortgage Amount: $500,000

Mortgage Rate: 3.99%

Mortgage Term: 10 years

Amortization: 25 years

Payment Schedule: Monthly

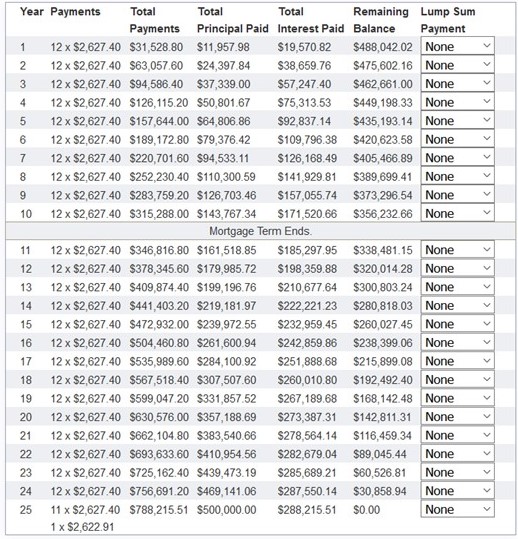

The table below shows you what a typical 25-year mortgage will look:

Total Payments = $788,215.51

Total Months = 300 months (25 years)

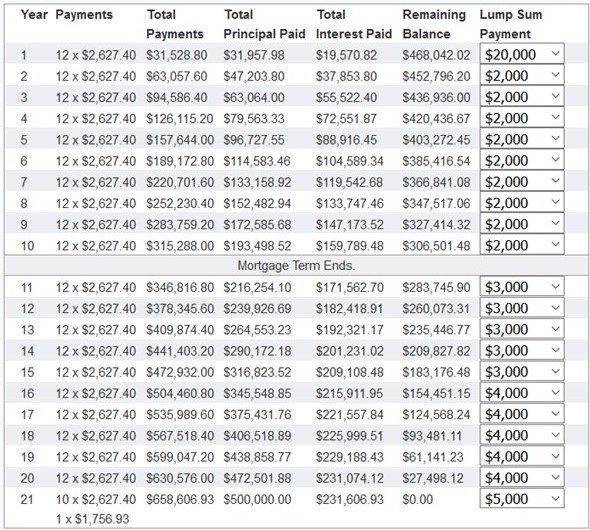

Now, here’s how you can save $129,608.58 and pay off your mortgage 4.1 years sooner. In the table below, you make a $20,000 lump sum payment in Year 1 using the dividends you have received so far from the 4 stocks listed above ($17702.31 + $2330.75). Then in each subsequent year you use the annual dividends received to make annual lump sum payments.

Total Payments = $658,606.93

Total Months = 251 months (20.9 years)

| Traditional Mortgage | Mortgage Using Dividends | Saved | |

| Total Payments | $788,215.51 | $658,606.93 | $129,608.58 |

| Total Months | 300 months | 251 months | 49 months (4.1 years) |

In these examples I’ve kept the numbers conservative your actual savings might be higher because in these examples:

- I only used 4 stocks, your stock portfolio may have additional stocks, and generate more dividends

- I assumed the $17702.31 received in dividends, was not re-invested. Ideally, you would re-invest the dividends as soon as they are received to earn more dividends

- I kept the dividend growth rate small, in reality the dividends received annually would increase each year (but in this example I only increased the lump sum in Year 11, 16, 21)

- Even though your annual dividends received are $2330.75 I’ve kept the numbers conservative to only show $2000 lump sum in Years 2 to 10

Let’s cover some common questions you may have:

This example requires me to invest approximately $27530.85, couldn’t I just save that money and get a smaller mortgage?

You could do that. But in the long-run you’re going to be better off investing the money. Consider the following facts:

- Total dividends received in 2018 will equal $17702.31, plus another $2330.75 in recurring annual dividends. After Year 5 you will have received $29356 in dividends which is more than your original investment

- Over the 25-year mortgage your total dividends received will be over $77,000

- You will continue to receive increasing dividends each year even after your mortgage is paid off

- Current average dividend yield is 8.51%, as long as your dividend yield is greater than your mortgage rate, it’s better to keep earning the dividends

How do I know dividends will keep going up?

Dividends are not guaranteed, companies are under no obligation to pay you dividends. Dividends can be reduced or cut at any time. However, we can look at the history of companies paying dividends, and history of increasing dividends to have a high degree of confidence that dividends will continue to be paid in the future.

| Company | Dividends Paid Since | Consecutive Years of Dividend Increases |

| Canadian Utilities | 1972 | 45 |

| Fortis | 1972 | 45 |

| Enbridge | 1953 | 23 |

| Canadian National Railway | 1995 | 22 |

| TransCanada | 1964 | 17 |

| Bell Canada | 1880 | 9 |

| Bank of Montreal | 1829 | 7 |

| Genworth | 2009 | 6 |

| Rogers | 2003 | 1 |

| Shaw | 2009 | 1 |

Here is the average dividend growth for the 4 companies used in this example:

| Company | Average Dividend Growth |

| TransCanada | 5.7% |

| Genworth | 60.1% |

| Rogers | 39.6% |

| Shaw | 20.9% |

What happens to the dividend if the stock price drops?

The dividend is generally not affected by the stock price, because the dividend is paid from earnings not from the stock price.

Here is an example from Enbridge, notice over the years the stocks price changes, in some cases dropping by $5 or $10 yet the dividend increases every year:

I don’t have the patience to time the stock market, how do I know when to buy stocks?

Everyone knows the term “buy low and sell high”. But how do you know when a stock is priced low (undervalued). Simple, just compare the stock’s current dividend yield to it’s average dividend yield. A stock is undervalued when it’s current dividend yield is higher than it’s average dividend yield. Here’s the simple formula:

If Current Dividend Yield > Average Dividend Yield then Stock is Undervalued

If Current Dividend Yield < Average Dividend Yield then Stock is Overvalued

Therefore, if a stock is undervalued, I should just buy it?

No. In addition to being priced low, you also have to make sure you are buying a quality stock (company). Make sure the company is profitable, has low debt, a history of increasing earnings, low payout ratio. I’ve created the easy-to-follow 12 Rules of Simply Investing to make sure you are investing in quality companies that will continue to pay increasing dividends for years to come.

Buying stocks seems complicated, couldn’t I just invest in Index funds or ETF?

You certainly could, but there is a price to pay for the convenience. Even though Index Funds and ETFs have much lower fees than Mutual Funds, you are still paying a fee. In the beginning the fees may seem irrelevant but they do add up when your portfolio starts to grow over six figures in value.

There are two other things to consider, with Index Funds/ETFs you:

- inadvertently end up buying stocks that are priced high (overvalued)

- inadvertently end up buying stocks that are not quality stocks, and non-dividend paying stocks

There are thousands of ETFs and Index funds to choose from, I would suggest it’s easier to follow the 12 Rules of Simply Investing to select a handful of quality dividend stocks.

I’m not ready to buy a house yet, when should I start this strategy?

The best time to start this strategy is sooner than later, especially if you are still 5-8 years away from buying your home. Dividend growth takes time, and the more time you have the more money you will have to burn your mortgage sooner than later.

An investment educator, Kanwal Sarai can teach how to grow your net worth and pay off your mortgage sooner, by investing in dividend value stocks. You can learn these simple investing principles from his online self-paced course, Simply Investing. Kanwal also publishes a monthly report which applies the 12 Rules of Simply Investing to 200 companies each month, so that you can know which quality and undervalued companies to invest in.

Sean Cooper is the bestselling author of the book, Burn Your Mortgage: The Simple, Powerful Path to Financial Freedom for Canadians, available now on Amazon and at Chapters, Indigo and major bookstores, and as an Audiobook on Amazon, Audible and iTunes.

What about added tax implications on earned dividends, or is the suggestion to hold in a TFSA account?

Hi Pete,

Great question! For this example, the suggestion is that the stocks are held in a TFSA account. In the TFSA account there is no tax on the dividends earned, and no tax on capital gains.

cheers,

Kanwal

Good food for thought 🙂 but that is simply just that. 🙂 There are so so many holes in this article.

1. We are assuming investors are capable of buying stocks in the midst of the worst financial crisis since the Great Depression. Studies show most people who got out during the crisis does not buy back in to the stock market only 5-7 years later. Have we forgotten how many solid financials and other stocks that have droppd 70% or more.

2. We are also assuming someone buying an expensive house with an expensive mortgage would have $25k cash on the side to invest. Given the assumption, this hypothetical person would be in the 30-40s. With that much savings he would be rather keeping those funds for emergency rather than investing in…once again, we are talking about the middle of a great crisis.

3. “The dividend is generally not affected by the stock price, because the dividend is paid from earnings not from the stock price.” Are we Cherry Picking here. There are many once solid companies that have reduce or cut their dividends after stock prices fall. To name just a few here…ECA CVE US companies: GE KHC VOD

Perhaps a far SIMPLER and SAFER approach to using a dividend stocks would be to use a VARIABLE rate mortgage instead of a fixed rate mortgage. Variable rates tend to be lower than the fixed rate. In the past 10 years, it has been averaging at 2.5% so this would be 1.5% cheaper than the 3.99%. The savings from the monthly payment can be used to prepay.

So instead of a monthly payment $2600 a month, you would be paying only $2200. That’s a $400 a month or a $4800 a year PREPAYMENT. Total interests over 30 years with the Variable rate is $172k instead of 290k. That is close to $120k of INTEREST saved. This is very close to what this Hypothetical example shows.

To give the cherry on top of the cake, the presumably $27k you had , you can keep it for a rainy day, spend it away or invest it.

Hi Jit Hoong Lim,

Thanks for taking the time to read my article and leaving your feedback, I appreciate it.

The “holes” you are taking about are the many variables/assumptions that need to be made for any article (blog post, news article, commentary). It’s impossible to cover all variables in a single article, variables such as, the home buyers age, occupation, salary, net worth, financial goals, martial status, their acceptable risk level, patience, discipline, investing knowledge, amount of money saved up, disposable income, amount of mortgage, years to retirement…..

I made a number of assumptions that I listed in my article, but again it’s impossible to list them all. My purpose was to highlight the importance of investing, investing early, having the patience to stay invested, creating a stream of dividend income, and if you wish using that dividend income to help pay off your mortgage sooner.

1. Yes, I am assuming investors were capable of investing (even during a market crash), in fact many of us (myself and my students) started investing before 2008 and continue to invest to this day. Only hindsight shows we were in a market crash, at that time no one knew how long it was going to last. My approach to investing is not for everyone, some people are only comfortable investing in GICs, and bonds, because it makes them feel safe, that’s fine…….I wasn’t write this article for them. I used my approach to pay off my first house in 5 years, again it might not work for everyone, some people might not have the temperament for it, but there is a small group of people who would be interested in learning about how I did it. Yes, stock prices did drop in 2008-2009 (creating a great buying opportunity), I didn’t forgot about the drops in stock prices, however, now the stock prices are up again, but I’m more focused on dividend growth….but here’s how the stock prices did after 08-09 (I also added in a financial and telecom as examples):

TRP stock price 2010: $35.50

TRP stock price 2019: $64.19

MIC stock price 2009: $24.30

MIC stock price 2019: $52.27

RCI.B stock price 2009: $29.05

RCI.B stock price 2019: $69.03

SJR.B stock price 2009: $18.50

SJR.B stock price 2019: $25.87

BMO stock price 2008: $31.25

BMO stock price 2019: $96.70

BCE stock price 2008: $24.95

BCE stock price 2019: $60.97

2. Sure, your assumptions may or may not be correct here…..this individual could be in their 20s, 30s, 40s. This individual could be self-employed, employed, or employed + running a side hustle. You could have $25K in cash, or you could have started investing at the age of 15 (like I did) and accumulated $15-$20K in stocks by the age of 27. There’s just too many variables (like I mentioned above), I’d like people to focus on the big picture, you don’t have to follow exactly what I’ve outlined here. But you do need to focus on investing early, time is on your side.

3. Yes, Encana (ECA), and Cenovus Energy (CVE) did reduce their dividend, but:

– the big 5 banks in Canada kept their dividend the same, and then began raising their dividend consecutively after the market down-turn ended. These banks have now had 8 years of consecutive dividend increases

– 28 blue-chip Canadian companies in fact continued to increase dividends each year even during the 08-09 market down-turn

– 80 blue-chip US companies continued to increase dividends each year even during the 08-09 market down-turn

I teach the importance of building a diversified portfolio of quality dividend-paying stocks. I personally had 3 stocks that reduced their dividend during 08-09, the remaining companies in my portfolio either kept the dividend the same or increased their dividends, the net result: my dividend income has gone up each year since I started investing (1998) and especially during 08-09 my dividend income went up.

You are correct about the benefits of a variable rate mortgage, I personally use variable rate mortgages. With a variable rate mortgage, the benefits (cost savings) of this example are even better as you’ve described. Again, not everyone has the risk tolerance to go with a variable rate mortgage, and some people prefer knowing exactly what their mortgage payments are going to be. Thank you for bringing this up, if I had to re-write this article I would put a note at the bottom indicating the benefits of going with a variable rate mortgage. Like I said, my purpose was to highlight the importance of investing, investing early, having the patience to stay invested, creating a stream of dividend income, and if you wish using that dividend income to help pay of your mortgage sooner.

“To give the cherry on top of the cake, the presumably $27k you had , you can keep it for a rainy day, spend it away or invest it.” Sure, or you could keep the money invested and after Year 5 you will have received $29356 in dividends which is more than your original investment…….and continue receiving dividends for life.

cheers,

Kanwal

Hi Kanwal, thank you for taking the time to write your reply and address some of the points I had mentioned. I appreciate that you were mindful that such a strategy may not for everyone and assumptions are assumptions. Investing can be very Simple and yet so Difficult to stay the course. Thanks for sharing with your readers how you invest and pay your mortgage (using variable vs fixed). It is true, to each their own. Myself, I am not a believer in repaying any or part of my mortgage. If I can leave it unpaid, that would be Ideal. Inflation will take care of itself! (and of course, not everyone is comfortable with this notion) Since this is the case, I would just reinvest those dividends to let it grow at a much faster pace than to repay the mortgage at a lower cost of capital.

Thanks again

Jit